As the new year dawns, Ned is in a fix. Should he finally freeze wages or deliver another pay raise?

His two-term predecessor, Democrat Dannel Malloy, froze state employee wages three times, leading the Hearst newspapers in Connecticut to run my recent column with a headline asking the pointed question “Why Can’t Lamont Freeze Wages?"

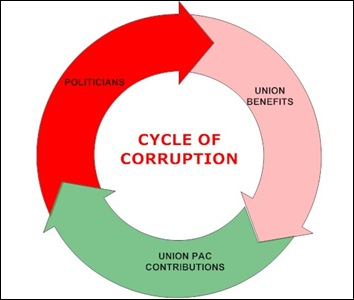

Trouble is, last spring Ned promised a state employee union convention “Every year that I’ve been here you’ve gotten a raise, and every year I’m here, you’re going to get a raise.”

Lamont was “here” in 2025, but state employees did not get a raise. They have been working without a wage contract since last June 30th.

State employees have received annual pay raises every one of Ned’s first six years in office. The raises compound to a whopping 33%, super-rich wages that elicited the Hearst headline implicitly asking “isn’t that enough?”

Can Ned deliver a seventh consecutive annual pay raise?

Maybe...